Presumption in Section 138 Case

Presumption in Section 138 Cases are different from ordinary criminal cases. Here, the law itself shifts the burden of proof after certain basic facts are shown.

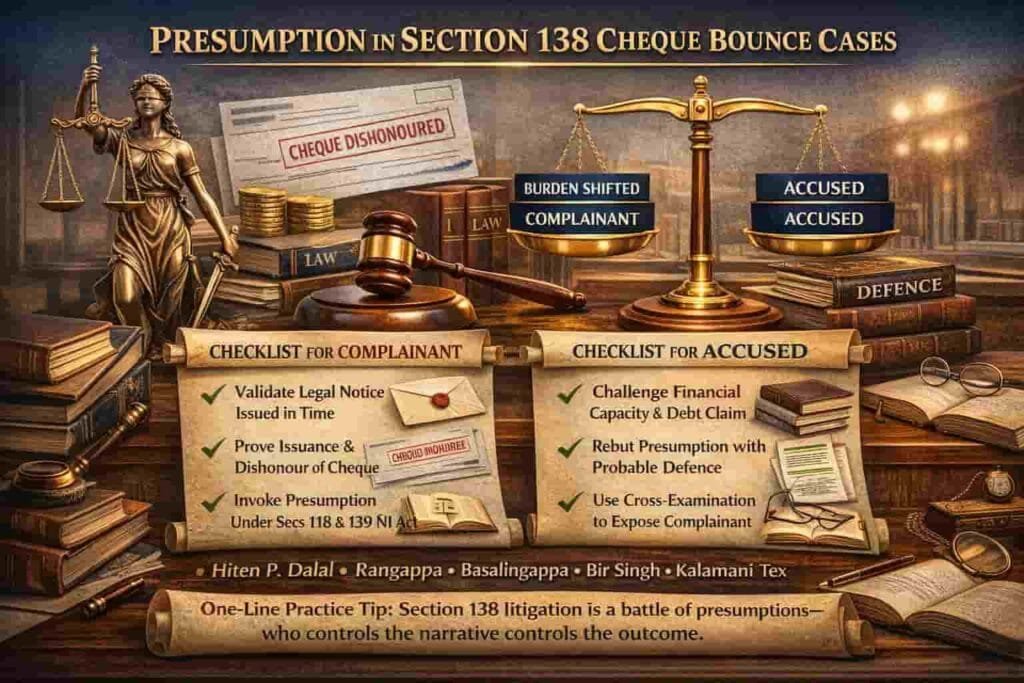

Once the complainant proves that the cheque was issued and dishonoured, the court is required to presume that the cheque was issued for a legally enforceable debt or liability. At this stage, the burden moves to the accused to rebut this presumption.

For lawyers handling cheque bounce matters, understanding how presumptions work, when they arise, and how they can be rebutted is essential. This article explains the law on presumption in Section 138 cases in simple terms, supported by leading Supreme Court and High Court decisions.

Provisions of Presumption in Section 138 Cases

In Section 138 proceedings, three provisions of the NI Act are most important:

- Section 118(a) – Presumption of consideration

- Section 139 – Presumption of legally enforceable debt or liability

- Section 146 – Presumption regarding bank return memo

These provisions work together and reduce the initial burden on the complainant.

Section 118(a) NI Act: Presumption of Consideration

Meaning and Effect

Section 118(a) states that every negotiable instrument shall be presumed to be made for consideration, unless the contrary is proved. In cheque bounce cases, this means the court will presume that the cheque was not issued without reason or value.

Once the execution of the cheque is admitted or proved:

- The complainant is not required to prove consideration at the start

- The court must presume that consideration existed

Practical Importance

This presumption applies even if:

- The cheque is post-dated

- The cheque is called a security cheque

- No written agreement is produced

Merely stating that the cheque was a “security cheque” does not rebut the presumption.

Section 139 NI Act: Presumption of Legally Enforceable Debt

Scope of Section 139

Section 139 provides that the court shall presume that the cheque was issued for the discharge of a legally enforceable debt or liability, either in whole or in part.

This presumption:

- Arises once the signature on the cheque is admitted

- Operates in favour of the complainant

- Continues until the accused rebuts it

Supreme Court Position

In Rangappa v. Sri Mohan, the Supreme Court clearly held that Section 139 includes a presumption about the existence of a legally enforceable debt, not only the issuance of the cheque.

Therefore, a simple denial of liability by the accused is not enough.

Section 146 NI Act: Presumption Based on Bank Return Memo

Section 146 states that the court shall presume the fact of dishonour on production of the bank’s return memo.

In practice:

- The complainant need not examine the bank official

- The reason mentioned in the return memo is presumed to be correct

- The accused must bring evidence to challenge the memo

This provision helps in speedy disposal of cheque bounce cases.

How Presumptions Operate Together in Section 138 Cases

In a typical cheque bounce case, presumptions operate in this order:

- Dishonour of cheque proved → Presumption under Section 146

- Execution of cheque proved → Presumption under Section 118(a)

- Cheque issued for liability → Presumption under Section 139

Once these presumptions arise, the complainant’s initial burden is discharged, and the onus shifts to the accused.

Nature of Presumption: Mandatory but Rebuttable

The words “shall presume” used in Sections 118 and 139 mean that the court has no discretion. The presumption must be drawn.

However, these presumptions are rebuttable. The accused is given a fair chance to disprove them.

Standard of Proof Required to Rebut Presumption

The accused is not required to prove the defence beyond reasonable doubt.

In Basalingappa v. Mudibasappa, the Supreme Court held that:

- The accused must rebut the presumption on preponderance of probabilities

- Even a probable defence is sufficient

- Defence evidence is not compulsory

The presumption can be rebutted through effective cross-examination of the complainant.

Common Defences to Rebut Presumption in Cheque Bounce Cases

1. Cross-Examination of the Complainant

The accused may point out:

- Contradictions in the complainant’s version

- Absence of documents supporting the loan

- Unclear source of funds

2. Financial Capacity of the Complainant

If the accused questions the complainant’s financial capacity, especially in large cash transactions, courts often require the complainant to explain the source of funds.

3. Security Cheque Defence

If the accused shows that:

- The cheque was issued only as security, and

- No liability existed on the date of presentation,

the presumption may be rebutted.

4. Time-Barred Debt

A cheque issued towards a time-barred debt does not attract Section 138 because the debt is not legally enforceable.

Admission of Signature and Its Effect

Once the accused admits the signature on the cheque:

- Presumptions under Sections 118 and 139 automatically apply

- The burden shifts completely on the accused

In Bir Singh v. Mukesh Kumar, the Supreme Court held that even a blank signed cheque, if voluntarily handed over, attracts presumption.

Presumption and Blank Cheques

The settled legal position is:

- The complainant is allowed to fill in the cheque details

- Filling up the cheque does not invalidate it

- Allegation of misuse must be proved by the accused

Presumption and Presumption of Innocence

Although Section 138 introduces a reverse burden:

- Courts have upheld its constitutional validity

- The offence is economic in nature

- The accused is given reasonable opportunity to rebut the presumption

Hence, presumption in cheque bounce cases does not violate criminal jurisprudence.

Stage-wise Application of Presumption in Section 138 Proceedings

- At cognizance stage: Presumption supports issuance of summons

- At notice stage: Accused must disclose a probable defence

- During trial: Presumption continues unless rebutted

- At final stage: Court evaluates defence against statutory presumption

Important Supreme Court Judgments on Presumption in Section 138 Cases

Some key judgments every cheque bounce we must know:

1. Hiten P. Dalal v. Bratindranath Banerjee

(2001) 6 SCC 16

Court’s View on Presumption

The Supreme Court held that the presumption under Sections 118 and 139 NI Act is mandatory in nature. Once execution of the cheque is proved, the court has no discretion and must raise the presumption.

Key Principles Laid Down

- Presumption is a presumption of law, not of fact

- Court must draw presumption once foundational facts are proved

- Accused can rebut the presumption, but mere denial is not enough

Importance for Lawyers

This case establishes that trial courts cannot ignore presumption merely because the accused disputes the transaction.

2. Rangappa v. Sri Mohan

(2010) 11 SCC 441

Court’s View on Presumption

The Supreme Court clarified that the presumption under Section 139 includes the existence of a legally enforceable debt, not just issuance of the cheque.

Key Principles Laid Down

- Presumption covers legally enforceable debt or liability

- Once signature is admitted, presumption automatically arises

- Accused must rebut presumption on preponderance of probabilities

Importance for Lawyers

This judgment settled conflicting views and made Section 139 stronger in favour of the complainant.

3. Basalingappa v. Mudibasappa

(2019) 5 SCC 418

Court’s View on Presumption

The Court explained how presumption can be rebutted and what standard of proof applies to the accused.

Key Principles Laid Down

- Accused does not need to prove defence beyond reasonable doubt

- Presumption can be rebutted through:

- Cross-examination of complainant

- Probable defence

- Financial capacity of complainant becomes relevant once questioned

Importance for Lawyers

This is a defence-friendly judgment, frequently relied upon to rebut presumption without leading defence evidence.

4. Bir Singh v. Mukesh Kumar

(2019) 4 SCC 197

Court’s View on Presumption

The Supreme Court held that even a blank signed cheque, voluntarily given, attracts presumption under Sections 118 and 139.

Key Principles Laid Down

- Filling up of cheque by complainant is legally permissible

- Blank cheque does not invalidate prosecution

- Accused must prove misuse, not merely allege it

Importance for Lawyers

This case closed the loophole of “blank cheque” defence commonly raised by accused persons.

5. Kalamani Tex v. P. Balasubramanian

(2021) 5 SCC 283

Court’s View on Presumption

The Court reiterated that once signature on the cheque is admitted, presumption is automatic, and courts should not insist on unnecessary proof from the complainant.

Key Principles Laid Down

- Trial courts should not shift burden back to complainant

- Presumption continues unless rebutted by accused

- Complainant need not prove loan transaction like a civil suit

Importance for Lawyers

This judgment corrects common trial court errors and strengthens complainant-side arguments.

6. APS Forex Services Pvt. Ltd. v. Shakti International Fashion Linkers

(2020) 12 SCC 724

Court’s View on Presumption

The Supreme Court held that even if a cheque is issued as security, presumption under Section 139 still applies if liability exists on the date of presentation.

Key Principles Laid Down

- Security cheque is not outside Section 138

- What matters is existence of liability on presentation date

- Presumption applies even in commercial transactions

Importance for Lawyers

This case prevents accused from escaping liability merely by calling the cheque a security cheque.

READ MORE: Difference between Summons Case, Warrant Case and Sessions Case under BNSS and BNS 2023

Order 39 CPC: Temporary Injunction | Explained in Marathi

FAQs on Presumption in Section 138 Cases

Q1. What is presumption under Section 138 of the NI Act?

Presumption under Section 138 means that once issuance and dishonour of the cheque are proved, the court presumes that the cheque was issued for a legally enforceable debt or liability, unless the accused proves otherwise.

Q2. What is presumption in a cheque bounce case?

In a cheque bounce case, the law presumes that the cheque was issued for consideration and towards a legally enforceable debt, under Sections 118 and 139 of the NI Act.

Q3. How can presumption under Section 139 NI Act be rebutted?

The accused can rebut the presumption by raising a probable defence on the basis of preponderance of probabilities, through cross-examination of the complainant or by producing defence evidence.

Q4. What are the common grounds for acquittal in a cheque bounce case?

Common grounds include:

- No legally enforceable debt

- Cheque issued as security without liability on presentation date

- Time-barred debt

- Failure to prove financial capacity of complainant

- Defective statutory notice

Q5. What is the burden of proof in presumption cases under Section 138?

Initially, the burden is on the complainant. Once presumptions apply, the burden shifts to the accused, who must rebut it on preponderance of probabilities, not beyond reasonable doubt.

Q6. What is the latest Supreme Court view on cheque bounce cases?

The Supreme Court has consistently held that presumptions under Sections 118 and 139 are mandatory, and courts should not insist on strict proof from the complainant once signature is admitted.

Q7. What is the new rule in cheque bounce cases?

There is no single “new rule”, but courts now strongly discourage technical defences and focus on the existence of legally enforceable liability and fair opportunity to rebut presumption.

Q8. How has the Kerala High Court viewed rebuttal of Section 139 presumption?

The Kerala High Court has repeatedly held that the accused can rebut presumption through cross-examination alone, especially by questioning the complainant’s financial capacity and the genuineness of the transaction.

Q9. What are valid defences against a cheque bounce charge?

Valid defences include:

- No debt or liability

- Security cheque without crystallised liability

- Cheque misused

- Statutory notice not served properly

- Cheque issued for time-barred debt

Q10. What is the difference between proof and presumption?

Proof requires evidence to establish a fact, while presumption is a legal inference drawn by the court unless disproved by the opposite party.

Q11. Is legal notice mandatory in a cheque bounce case?

Yes. Issuance of a statutory legal notice within 30 days of dishonour is mandatory. Without valid notice, a complaint under Section 138 is not maintainable.

Q12. How can an accused defend a false cheque bounce case?

The accused can defend by:

- Challenging the existence of debt

- Proving misuse of cheque

- Exposing contradictions in complainant’s case

- Producing documentary evidence

Q13. Is 20% interim compensation mandatory in cheque bounce cases?

No. Interim compensation under Section 143A NI Act is discretionary, not mandatory. The court must apply judicial mind before directing payment.

Q14. Can presumption alone result in conviction under Section 138?

Yes, if the accused fails to rebut the presumption, conviction can be based on statutory presumptions alone.

Q15. Does denial of debt rebut presumption under Section 139?

No. Mere denial of debt is not sufficient. The accused must raise a probable and credible defence.

Conclusion: Presumption Decides the Outcome of Section 138 Cases

In cheque bounce cases, presumption is the deciding factor. For the complainant, it reduces the burden of proof. For the accused, it demands a clear and consistent defence.

For lawyers, success in Section 138 matters depends on how well presumptions are invoked, challenged, and rebutted. In modern cheque dishonour litigation, understanding presumption law is not optional—it is essential.